how are annuities taxed to beneficiaries

But taxation on contributions and. Income from annuities is taxed as ordinary income.

Beneficiaries Pay No Taxes On Non Registered Annuities Annuity Quotes Annuity Life Insurance Quotes

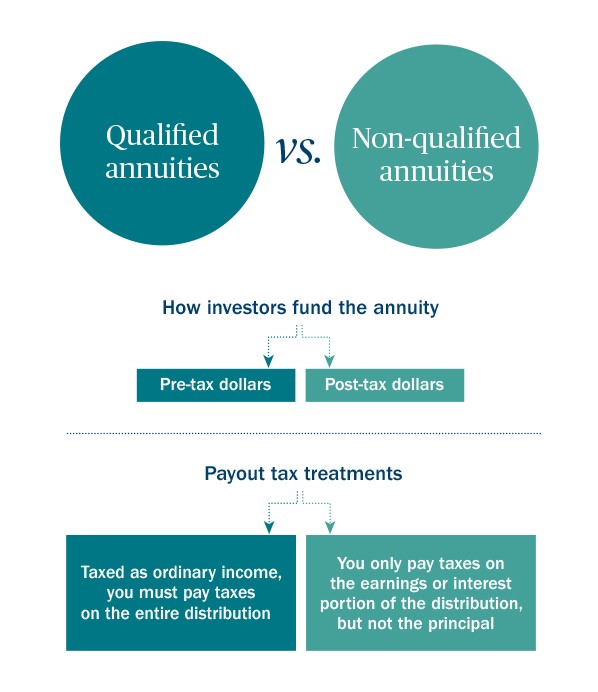

If you want to understand how an inherited annuity is taxed two terms that are critical to grasp are qualified annuities and non-qualified annuities.

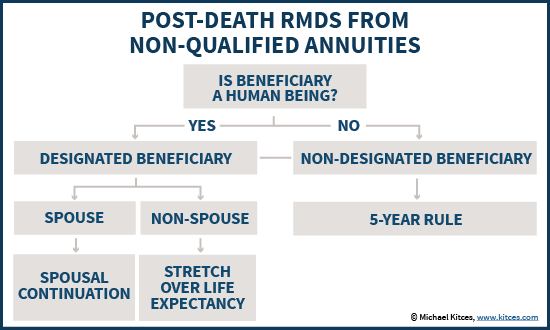

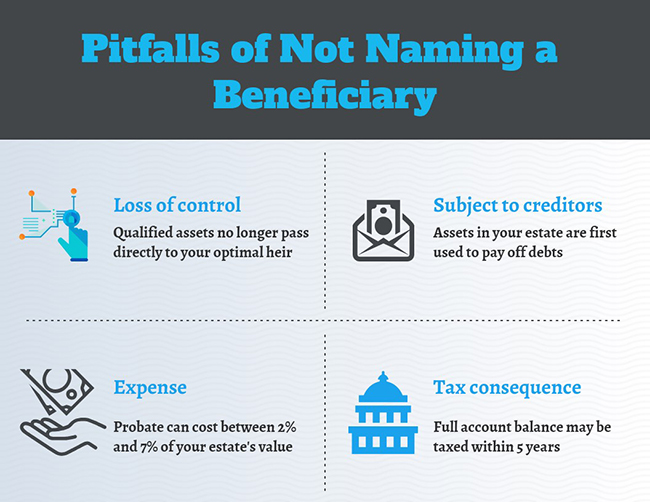

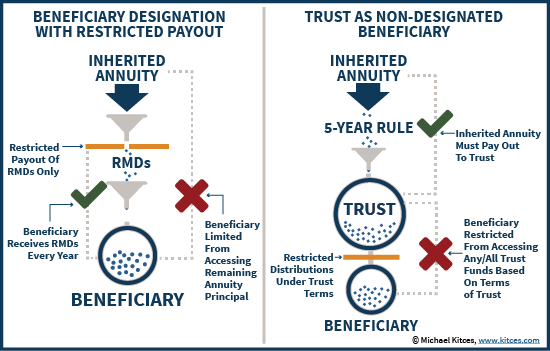

. Ad Learn some startling facts about this often complex investment product. Inherited annuities are taxable as ordinary income. As a result consideration of whether to use a trust as the beneficiary of an annuity must weigh the adverse tax consequences against the favorabledesired non-tax provisions of the trust.

This is a good option unless your spouse needs to access the funds and is younger than 59 12. Again annuity withdrawals are taxed at the ordinary income tax rate not at the capital gains rate. Annuities complement other retirement plans and depending on what type you select they may provide guaranteed lifetime income opportunities for tax-deferred growth guaranteed yield.

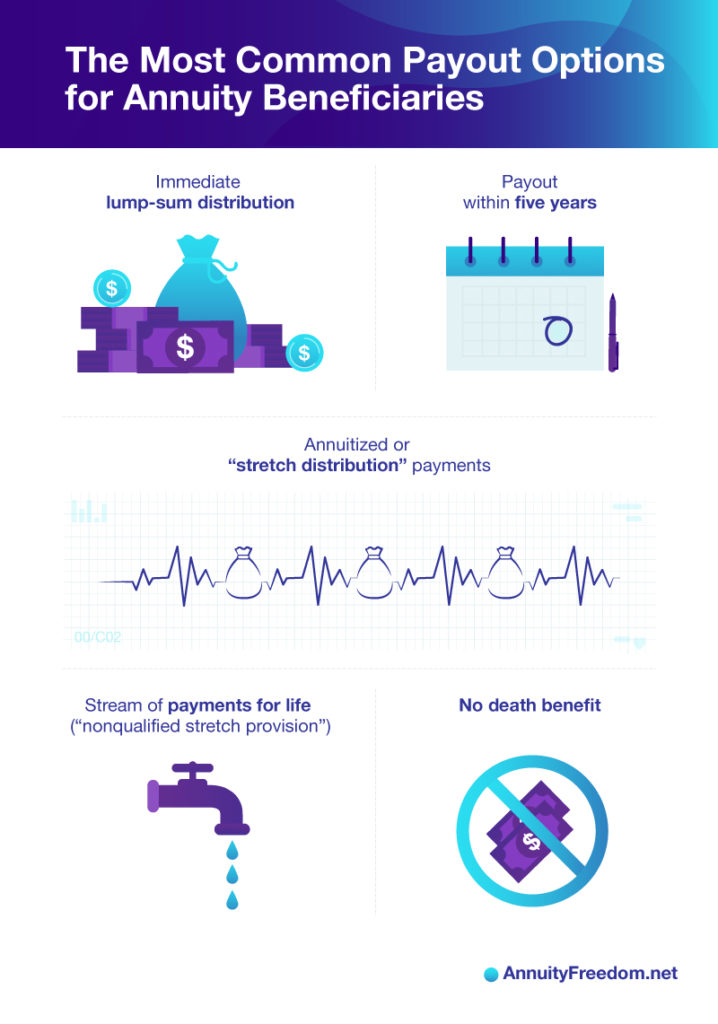

Withdrawals below that age are subject to an additional 10 percent tax penalty so its. The problem with taking a one-time lump sum is that you trigger tax on the entire amount of deferred income that the annuity generated. To avoid taxes on inheritance for your beneficiaries utilize a deferred annuity or a life insurance policy.

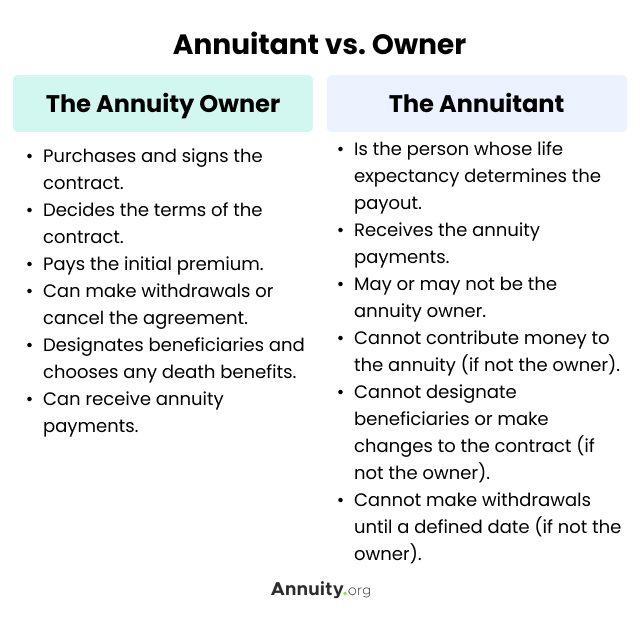

You can lower the taxable amount of your RMD by. Understanding how inherited annuities are taxed starts with knowing the difference between qualified and non-qualified annuities. If the payout is over an annuitants lifetime and the annuitant outlives life expectancy all further payments.

Annuities offer enhanced death benefits to. When an annuity payment is made 50 of each payment would be income taxable. How taxes are paid on an inherited annuity will depend on the payout structure selected and the status of the beneficiary.

Any growth or earnings inside of an annuity are tax-deferred until you start receiving income from the annuity. When someone inherits an annuity they owe taxes on the proceeds. There are different tax consequences for spouses vs non-spouse.

They do not receive the benefit of being taxed as capital gains. Ad Learn More about How Annuities Work from Fidelity. How To Pass Money To Heirs Tax-Free.

If a beneficiary chooses to take the money all at once they have to pay. Depending on the payout structure as well as the beneficiarys relationship to the annuity owner the taxed. Ad 11 Tips You Absolutely Must Know About Annuities Before Buying.

Withdrawals and lump sum distributions from an annuity are taxed as ordinary income. The original annuity contract holder must include a death benefit provision and name a beneficiary. However the downside of doing so is that for an annuity held outside an IRA the entire amount of the appreciation between.

Converting your traditional IRA to a Roth IRA. But who the beneficiary is. How Inherited Annuities Are Taxed.

Ad Learn More about How Annuities Work from Fidelity. Pro Tip How taxes are determined. Yes any earnings from inherited annuities are subject to taxation.

The simplest is to elect an immediate lump sum. The taxed amount depends on the payout structure and the beneficiarys relationship with the annuity owner as a surviving spouse or otherwise. Just like any other qualified account such as a 401k or an individual.

Designating Others When you specify someone else as your beneficiary such as a child or spouse the money will pass by contract. How Annuities Are Taxed. So if the annuity buyer paid 10000.

Ad Learn some startling facts about this often complex investment product. If you inherit an annuity youll have to pay income tax on the difference between the principal paid into the annuity and the value of the annuity when the owner dies. If they choose a lump sum beneficiaries must pay owed taxes.

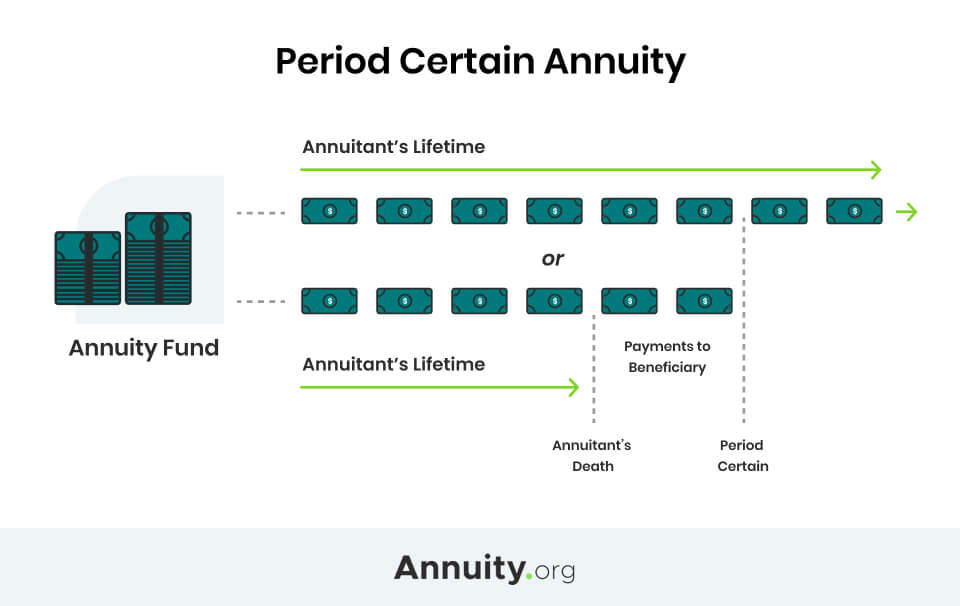

Taking your RMD as a series of payments throughout the year. And the beneficiary doesnt owe taxes until they withdraw the funds. Beneficiaries of Period-Certain Life Annuities.

Investing in a Qualified. An annuity is qualified if. Whether or not an inherited annuity is subject to inheritance or estate tax the beneficiary is liable for income tax.

Some annuities are period-certain annuities which combine the benefits of a fixed annuity and life annuity by guaranteeing both. For example if the owner. The earnings in your variable annuity account become taxable only when you withdraw money or receive income from the insurer in the payout phase of the annuity.

How Do Beneficiary Designations Affect Your Retirement Planning

Abney Associates Ameriprise Financial Advisor In Melville Ny Ameriprise Financial Financial News Financial

Inherited Annuity Tax Guide For Beneficiaries

Difference Between Annuitant And Beneficiary Difference Between

Compare Annuity Rates Annuity Lifetime Income Investment Advice

Trust Vs Restricted Payout As Annuity Beneficiary

Annuitant What It Is And How It S Different From The Annuity Owner

Period Certain Annuity What It Is Benefits And Drawbacks

Annuity Beneficiaries Inheriting An Annuity At Death 2022

Annuity Beneficiaries Inheriting An Annuity After Death

Annuity Beneficiaries Inheriting An Annuity After Death

Abney Associates Ameriprise Financial Advisor In Melville Ny Ameriprise Financial Financial News Financial

Taxation Of Annuities Ameriprise Financial

Offset Taxes On Inherited Iras With This Annuity Annuity Inherited Ira Ira

Living Abroad What About My South African Family Trust Family Trust South African South

Annuity Beneficiaries Inheriting An Annuity After Death